how to declare mileage on taxes

You can check Tips on Calculating Mileage Deductions on how to compute each method and which one is the best to utilize. Rates per business mile.

:max_bytes(150000):strip_icc()/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Standard Mileage Rate Definition

The deductible amount is the standard mileage rate multiplied by the number of miles you traveled.

. Your employee travels 12000 business miles in their car - the approved amount for the year would be 5000 10000 x 45p. If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. You must file a tax return if you have net earnings from self-employment of 400 or more from gig work even if its a side job part-time or temporary.

The mileage tax deduction is calculated by multiplying qualified mileage by the annual rate set by the Internal Revenue Service. For qualifying trips for medical appointments the rate is 016mile. If you use the actual expense method to claim gasoline on your taxes you cant also claim mileage.

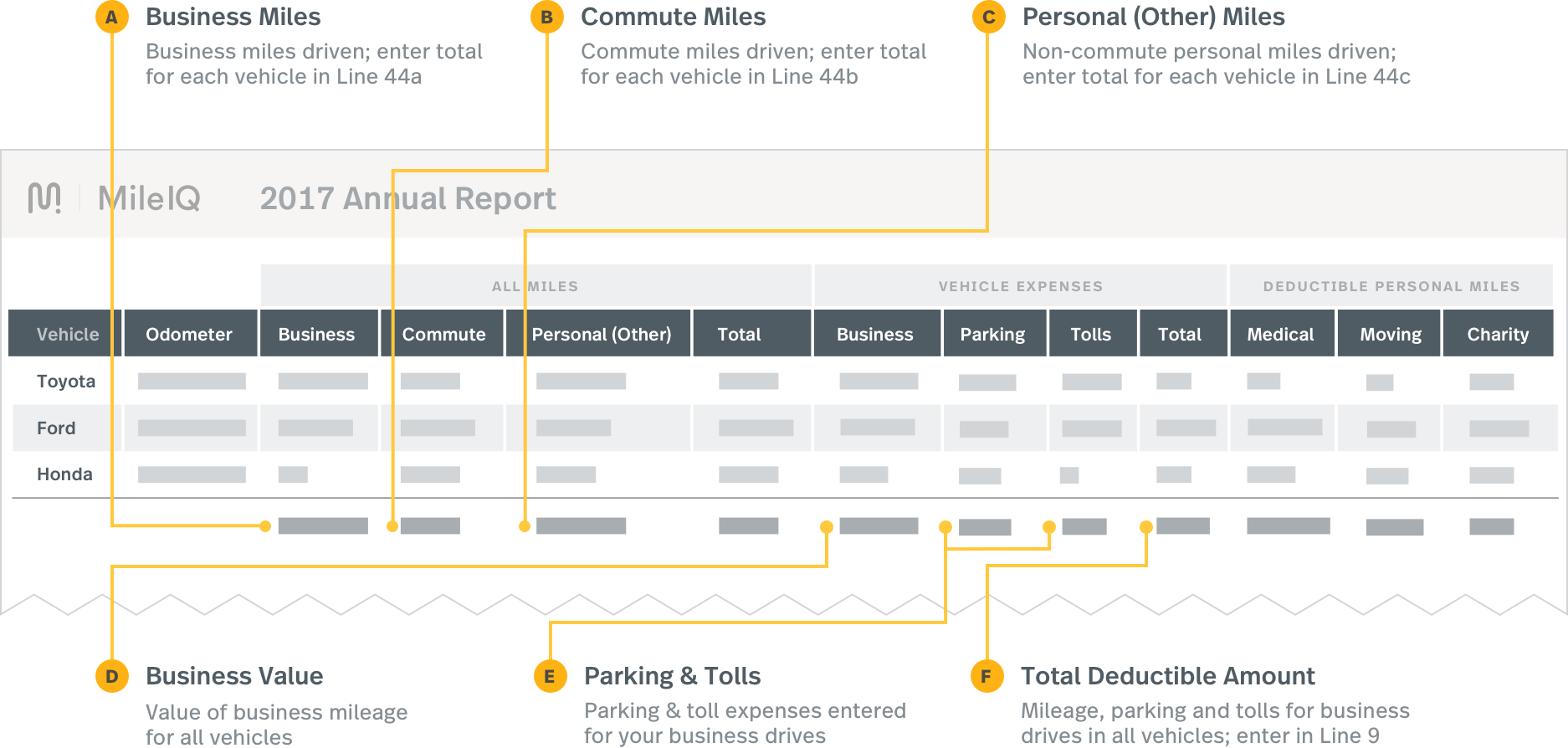

The total mileage number must be indicated on. Every feature included for everyone. The business portion is calculated the same way as mileage above.

If you are an employee you cannot deduct gas mileage as an unreimbursed expense on your tax return. If you travel away from home for business reasons you can deduct mileage related to those trips as an unreimbursed employee business expense on Schedule A Form 1040. Business expenses for employees are generally non-deductible as of the Tax Cuts and Jobs Act of 2017 TCJA.

For volunteer work the rate is 014mile. You would figure your standard mileage rate deduction on IRS Form 2106 and report this amount on Schedule A of IRS Form 1040. Easily E-File to Claim Your Max Refund Guaranteed.

The standard IRS mileage rate for the 2021 tax year is 056miles. If you do gig work as an employee your employer should withhold tax from your paycheck. Record Your Vehicles Odometer.

Enter your mileage expense by completing form 2106 employee business expenses. Business miles annual mileage business use. If you use the actual expense method to claim gasoline on your taxes you cant also claim mileage.

Calculate Your 2022 Tax Return 100. This is the easiest method and can result in a higher deduction. Ad The Leading Online Publisher of National and State-specific Legal Documents.

535 cents per business mile 17 cents per mile for medical miles moving miles When completing your tax returns youll list the total amount of miles driven on form 2106 line 12. Multiply the standard mileage rate by your total miles driven or determine your actual expenses for the year. Your beginning vehicle mileage.

Enter your mileage expense by completing Form 2106 Employee Business Expenses. For the 2021 tax year the rates are. You must pay tax on income you earn from gig work.

The mileage tax deduction is. If you do gig work as an independent contractor you. If youre self-employed or an independent contractor however you can deduct mileage used solely for business purposes as a business-related expense.

How to deduct mileage for taxes for the self employed. How To Declare Taxes As An Independent Consultant Sapling Jamberry Business Lularoe Business Thirty One Business. Uber makes it easy to track your online miles.

Standard mileage method it requires you to keep a track of your mileage. Standard IRS Mileage Deduction. The IRS requires taxpayers to disclose the total number of miles driven by their car during the tax year.

The basis is multiplied by our business-use percentage to determine the depreciable basis of the vehicle for tax purposes. Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. Ad Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly.

What Are The 2021 2022 Irs Mileage Rates Bench Accounting Standard Mileage Rate Definition Form 2106 Employee Business Expenses Definition. Determine Your Method of Calculation. You would figure your standard mileage rate deduction on IRS Form 2106 and report this amount on Schedule A of IRS Form 1040.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)

Form 2106 Employee Business Expenses Definition

How To Claim Mileage And Business Car Expenses On Taxes

What Are The Mileage Deduction Rules H R Block

![]()

25 Printable Irs Mileage Tracking Templates Gofar

What Are The 2021 2022 Irs Mileage Rates Bench Accounting

How To Claim Vehicle Expenses On Your T2125 Turbotax Support Canada Youtube

How To Claim The Mileage Deduction Write Off Car Expenses Uber Eats

Mileage Vs Actual Expenses Which Method Is Best For Me

Mileage Log Template Free Excel Pdf Versions Irs Compliant

Free Mileage Log Template For Excel Everlance

Mileage Log Template Free Excel And Pdf Template With Download

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

What Business Mileage Is Tax Deductible

.png)

Mileage Vs Actual Expenses Which Method Is Best For Me

Reporting Mileiq Mileage With Tax Software Mileiq

How To Deduct Mileage If You Are Self Employed 2022 Turbotax Canada Tips

Self Employed Mileage Deduction Guide Triplog

25 Printable Irs Mileage Tracking Templates Gofar

Business Mileage Deduction 101 How To Calculate Mileage For Taxes